Dreaming of Your Perfect Home?

Don't Let Bad Credit Get In The Way of Your Dream of Buying a Home...

The Guide To Buying Your Home

While you are in our Credit Repair Organization Program, we are disputing inaccurate, incomplete items on your consumer report pursuant to the Fair Credit Reporting Act. Getting approved for your home is easy when you have the right team of experts guiding you all the way through.

How Are We Different?

We are a Credit Repair Organization that performs Credit Repair Organization Work. With our program, you get unlimited custom disputes targeting both credit bureaus and data furnishers. Plus, we offer Credit Building Tools to speed up your credit repair organization work. Since everyone's credit situation is different, we recommend scheduling your free consultation today.

Full-Service Credit Repair Organization Work

Unlimited Disputes to All 3 Bureaus

Unlimited Disputes to Data Furnishers

Custom Letters Tailored to Your Situation

Credit Building Tools

24/7 Access to Client Drive

Credit Updates Every 35 Days

Disputes Always Sent Via Certified Mail

Professional Credit Audit and Analysis Report

Absolute Best Customer Care Around

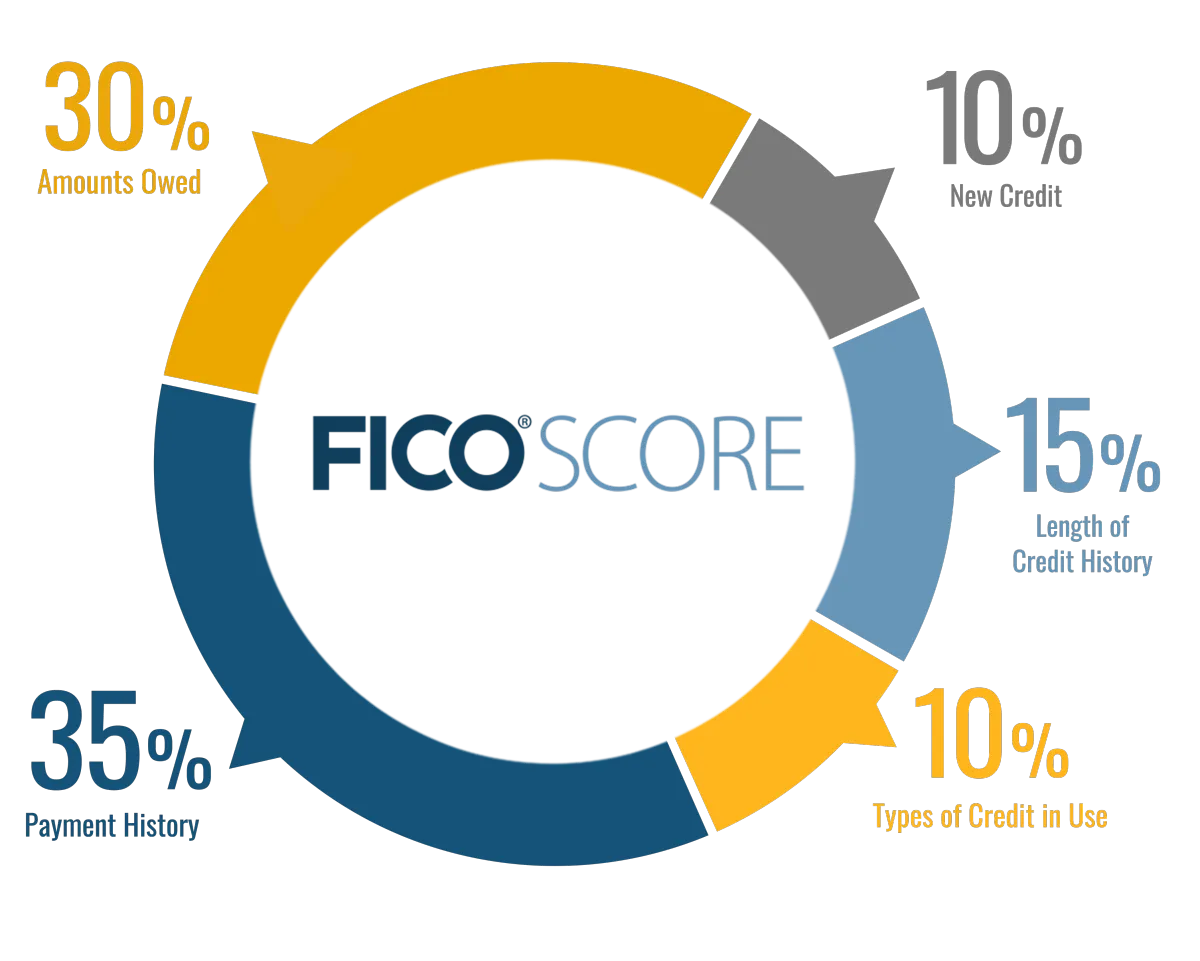

COMPONENTS OF CREDIT

Your FICO score is made up of data from your credit report that breaks down into these five components. Each component works with and against each other, so what works for one credit profile might not work for another.

NEW CREDIT

New credit accounts for 10% of your FICO Score. It includes the number of new accounts you have and any hard inquiries on your credit report. To keep your score healthy, avoid unnecessary credit checks and open new accounts carefully. Think about how new accounts will affect your credit mix, the length of your credit history, your payment history, and your total debt. Managing credit is all about finding the right balance.

AMOUNTS OWED

The "amount owed" category makes up 30% of your FICO score. This includes credit cards and department store cards, which are revolving lines of credit. These accounts are important for your FICO score, and how much you use them affects your score. We look at each account, its limit, statement date, and due date to give you advice. We can tell you exactly how much to pay on each account to get the most FICO points.

PAYMENT HISTORY

Payment history makes up 35% of your credit score, making it the most important factor. It looks at how well you make minimum payments on time for each credit account. This includes credit cards, store cards, mortgages, and loans, as well as any negative records. Your payment history can become complicated as more information is added. To improve this, ensure you don’t negatively impact other areas like the amount owed, length of credit history, or new credit.

LENGTH OF CREDIT HISTORY

Length of credit makes up 15% of your FICO score. This category looks at when you opened your accounts and the last time you used them. FICO considers your oldest accounts, new accounts, and the average age of all your accounts. Long-term account holders are viewed more favorably, so you should avoid closing accounts if you make your payments on time. Even though this category only makes up 15% of your score, having a long credit history is always a plus for FICO.

TYPES OF CREDIT IN USE

Credit mix measures the types of credit you use, including revolving credit (like credit cards) and installment credit (like loans). It makes up 10% of your FICO score. Some people think this category isn't important, but it can help if you don't have a strong credit history. It's important to have a variety of accounts, but make sure this doesn't hurt your length of credit history, payment history, or new credit.